![]()

Learn More About Our Services

The Main Questions on Private Equity Explained Simply

For More Information Please Contact Us

General

General

Reasons to invest in Private Equity : A highly attractive asset class

Investing in unlisted companies, continues to benefit from low correlation with other asset classes, making it a valuable source of diversification for investment portfolios.

Returns are generally higher than those of listed equities due to the nature of these investments, which often involve active management strategies, restructuring or growth of investee companies.

In the US, Private Equity has significantly outperformed the S&P 500 over 5, 10 and 20 years. For example, over a 20-year period, the annualised performance of private equity is +9.9%, compared with +5.9% for the S&P 500. This higher performance is partly explained by access to private companies, often with high growth potential, and operational improvement strategies that are not always available in public markets.

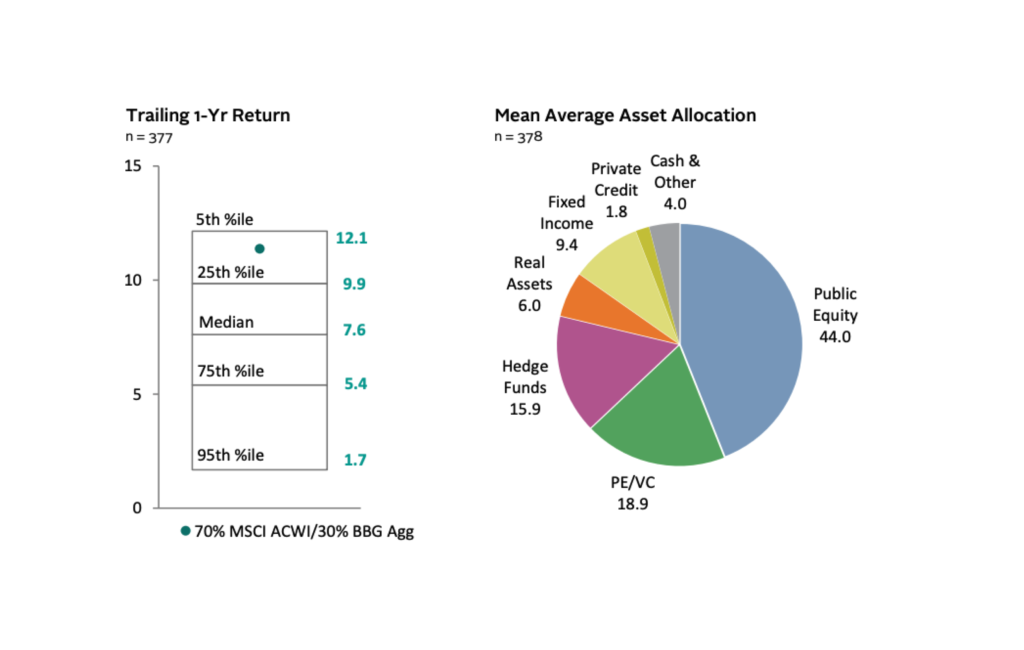

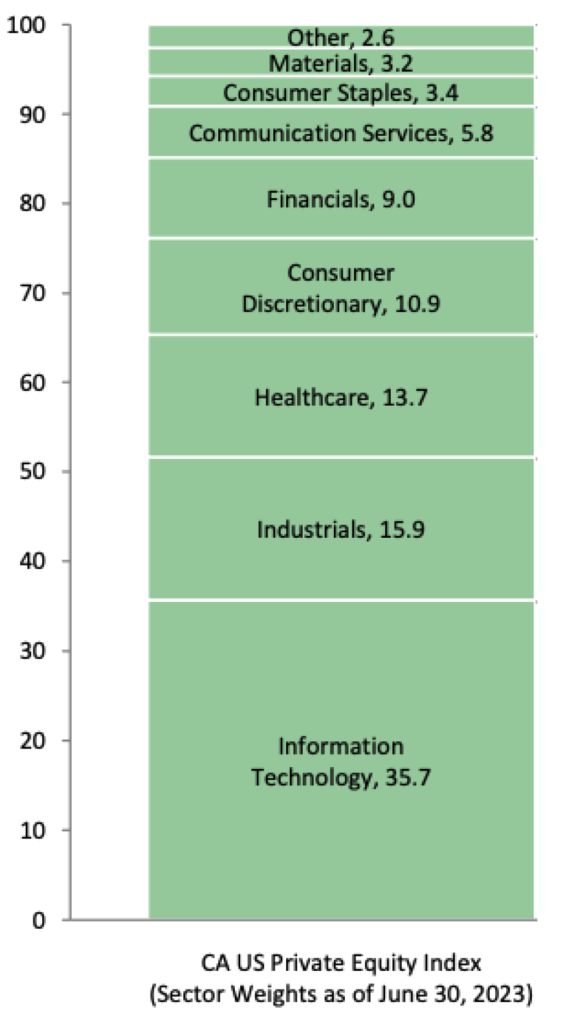

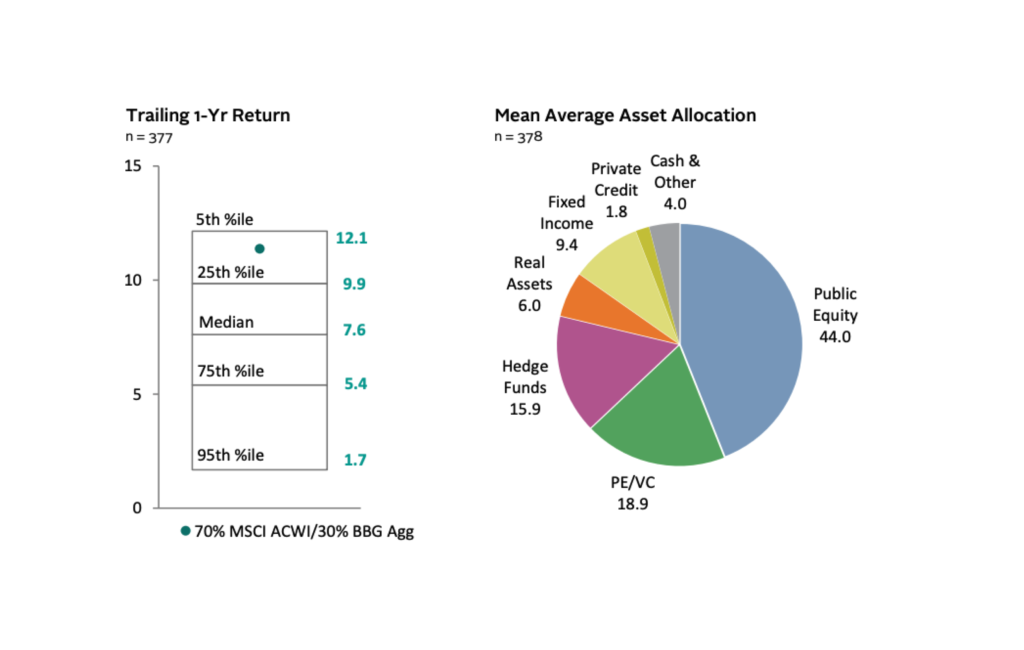

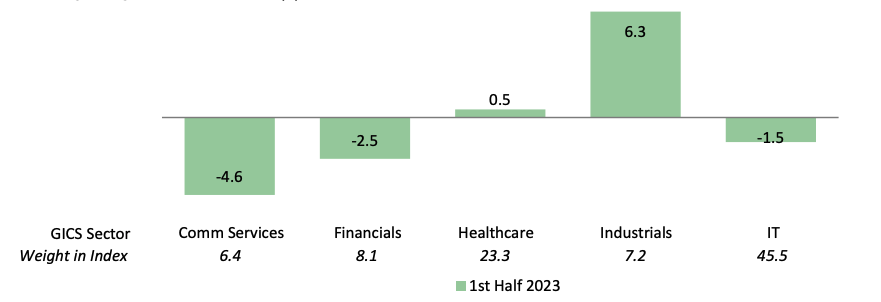

Recent Private Equity investment returns outperforming listed markets

According to the latest data from Cambridge Associates for the first half of 2023, Private Equity in the US generated an annualised return of 9.8% over 20 years, outperforming the S&P 500, which returned 7.9% over the same period. This confirms the historical trend that Private Equity investments outperform over the long term. In Europe, according to Invest Europe, LBO funds have also delivered strong annualised returns, reaching around 15% per year over several decades, compared with 5-6% for the MSCI Europe (US PE/ VC BENCHMARK COMMENTARY / Private Investment Benchmarks / ENDOWMENTS QUARTERLY).

The opportunity to make a difference

By funding companies that you believe in and allowing them to grow, you are actively involved in turning an idea into reality. As a direct investor, you can get involved in the company’s development if you wish.

Investments in tangible assets

Private equity is not just a financial or virtual product. It gives you real meaning to your asset allocation. You invest in businesses you believe in.

The world belongs to those who invest early.

Une diversification optimale de votre fortune

Investing in Private Equity means taking majority or minority stakes in unlisted companies.

This allows you to diversify your investments while at the same time investing in the real economy, in direct contact with the companies you support.

The aim is to make significant capital gains over the medium to long term by selling all or part of your holding when the company goes public or is sold.

And because you are one of the first shareholders, you benefit most when you succeed.

Invest Direct focuses on 3 types of Private Equity investments:

- Venture capital, which finances young and often technology-based companies, is the best known. We prefer companies with a proven track record (e.g. having raised several rounds of financing)

- Growth capital, which supports companies that want to increase their production capacity, expand their sales force or acquire other companies. In this case, we focus on profitable SMEs

- Leveraged transactions, where a company is sold to a group of individuals (usually the management). We could find long-term investors to provide these managers with additional equity. They would then buy the business together in a leveraged buy-out (LBO)

Des rendements récents qui dépassent ceux des marchés cotés

D’après les données récentes de Cambridge Associates pour le premier semestre 2023, le Private Equity aux États-Unis a produit un rendement annualisé de 9,8 % sur 20 ans, surpassant ainsi le S&P 500, qui a affiché 7,9 % pour la même période.

Cela confirme la tendance historique observée où les investissements en Private Equity offrent des performances supérieures sur le long terme.

En Europe, selon Invest Europe, les fonds de LBO affichent également des rendements annualisés élevés, atteignant environ 15 % par an sur plusieurs décennies, comparés aux 5 à 6 % pour le MSCI Europe (US PE/ VC BENCHMARK COMMENTARY / Private Investment Benchmarks / ENDOWMENTS QUARTERLY).

L’occasion de faire la différence

En finançant des sociétés qui vous convainquent et en leur permettant de se développer, vous participez activement à la transformation d’une idée en réalité. En tant qu’investisseur direct, vous pouvez le cas échéant vous impliquer dans le développement de l’entreprise.

Des investissements tangibles

Loin des produits exclusivement financiers ou purement virtuels, le Private Equity permet de redonner un véritable sens à votre allocation d’actifs. Vous investissez dans des entreprises auxquelles vous croyez.

Le monde appartient à ceux qui investissent tôt.

Les risques de perte de capital

Our vetting methods mitigate some of this risk. However, as with the stock market (e.g. Enron in the USA or WireCard in Germany), you may lose all or part of your investment.

Liquidity

These companies are privately owned and are not listed on the stock exchange. As a result, you cannot sell your shares on an organised secondary market. However, we encourage companies to organise liquidity periods. This allows you to offer your shares to other subscribers on a regular basis and in full transparency with the companies.

Valuation

Stock market listings provide a market value for your investment on a daily basis, which is not the case with Private Equity. To overcome this disadvantage, our platform provides you with an independent valuation of your holdings on a quarterly basis. However, this valuation may differ (up or down) from the price received in a liquidity event. In addition, access to our platform is restricted to qualified investors.

A Company

A Company

Signature of the Invest Direct contract

We get to know each other and establish a partnership based on your needs.

Creation of your company profile

You access your personal space to complete your profile, which will serve as a showcase for our community of investors. It must be detailed and include key information such as stage of development, business sector, valuation, type of transaction envisaged, etc.

Expertise

We carry out a study of your company with partner. This exclusive, independent partner provides a rigorous analysis of the financial, strategic and operational aspects of your business.

Operation structuring

Our team of experts provides you with personalised support and guide you in structuring the key parameters of your financial deal. We also offer you the opportunity to securitise your capital for distribution to financial institutions..

Posting of your company page and promotion

Your company is visible on the platform and is included in our catalogue of investment opportunities. Our community of investors can access your profile at any time. We are committed to ensuring that your company attracts the attention of potential investors.

Support

We’re with you every step of the way. Your company profile will remain active and accessible for future funding needs.

We strongly recommend that you update your information regularly so that our community of investors receives your news and remembers you.

We charge a 4% commission on funds raised through our platform, ensuring that our interests are aligned with your success.

Support, independent assessment and valuation : CHF 11’000

Vendor Due Diligence : Tailored offer

Success fee : 4% of funds raised through Invest Direct

- Data Collection

- Company fundamentals

- Company history

- Financial information

- Documentation and legal aspects

- Business plan (3 to 5 years)

- List of partnerships and clients

- Intellectual and/or industrial property portfolio

- Description of technology

- Latest accounts/balance sheets (even unaudited) and those for the last three years

2. Interviews with management

- corporate strategy

- type of transaction suggested

3. Corporate Analysis

- Target Market

- Products and Services

- Business Model

- Balance Sheet and Cash Flow Analysis

- Financial Ratios

- Cash and Liquidity

- Debt and Insolvency

- Performance and Viability

- Business Plan with Industry Benchmarks

- Multi-Year Balance Sheet Analysis

- Financial Valuation

- Estimation of Future Value

It depends on the availability of documents, but generally between 3 and 6 weeks.

No documents are freely available on our site. A summary document is available to investors registered on our marketplace (private investors, wealth managers). Additional information is generally available subject to the signing of a confidentiality agreement.

Our team of professionals is available to assist you with your financial transaction. This may include legal aspects and/or the financial structuring of your transaction.

Yes, we charge a 4% success fee on funds raised through the Invest Direct platform.

A Qualified Investor

A Qualified Investor

Private Equity is only suitable for investors who are qualified or considered to be qualified Swiss law (LSFin art 5, al.1-2) accepts that anyone who validly declares that he or she has :

- the knowledge required to understand the risks of investments as a result of their personal training and professional experience or comparable experience in the financial sector, AND assets of at least CHF500,000.

- or assets of at least CHF2,000,000.

Invest Direct is aimed at professional investors who understand and accept the specific characteristics of Private Equity. These investments present significant risks of partial or total loss of capital. A Private Equity allocation should not exceed 10% of the investor’s net assets.

In order to outperform listed markets, the main characteristic of private equity is that it remains illiquid. As such, the duration of your investment generally depends on the company’s lifespan and its successful development. However, the possibility of investing through dedicated investment vehicles with an ISIN code allows you to increase the liquidity of your position. For comparison, when you invest in a fund, it’s often for a minimum of 7, or even 10 to 12 years, as intermediate liquidity is rare and often detrimental to your performance. Private equity giants, however, offer these opportunities… but it’s notoriously impossible to invest reasonable sums in them.

The liquidity announced is not guaranteed, but a company’s willingness to organize/guarantee it is an obvious selection criterion for us. Under the leadership of Invest Direct, companies can establish regular liquidity periods because the securitization of the proposed transactions greatly facilitates access to liquidity. However, it cannot be guaranteed. By way of comparison, when you invest in a fund, it is often for a minimum of 7, or even 10 to 12 years, with intermediate liquidity being rare and often detrimental to your performance. Private equity giants, however, offer these possibilities… but it is notoriously impossible to invest reasonable sums in them.

To the extent that you are investing in private debt, with a return expected at subscription, the latter is predictable.

When subscribing to the capital of a company, this will depend on your entry price and the date of transfer of your shares.

We charge a 4% success fee on funds raised by the company through our community.

Access to our services is free. Simply request to unsubscribe and your profile will be immediately deleted in accordance with applicable Swiss data protection laws.

At no time will your money pass through Invest Direct. Your investment is made directly with the company you have chosen or by your wealth manager via a custodian bank if the transaction is securitized.

A Wealth Manager / Private Banker

A Wealth Manager / Private Banker

We’re actively working to offer ISIN codes for a growing number of transactions. This will help increase their value in your clients’ portfolios. Regardless, if your clients are looking to make direct investments, it’s better to offer them an effective solution than to disappoint them. You’ll then become their “go-to” partner, which could lead to a more profitable relationship.

If your client wishes to invest, it is possible to provide for a subscription commission in the vehicle holding each transaction, in complete transparency and within the limits provided for by the law in force in your jurisdiction.

Despite higher returns than the markets, we understand that Private Equity may remain exotic for some of you.

NWe are working to make this asset class more accessible and transparent. This could take the form of thematic meetings or training sessions with recognized experts, aimed at the following profiles: wealth managers, private bankers whose clients wish to invest.

An Investment Banker / Broker

An Investment Banker / Broker

For an investment bank or an M&A professional mandated by a company

Thanks to our completely independent analysis, you can submit your deal flow to us and focus on the advice you offer your client. You gain productivity by delegating a company’s detailed analysis to us. You integrate those of Apollonian and its 12 analysts into your own services. If we distribute a portion of your transaction to our community of investors, we will charge a 4% success fee on the amount actually invested. Don’t hesitate to contact us for more details.

Present a company that has not immediately planned a financial transaction:

Our partner can evaluate or value a company that will complete a transaction in the future. We will soon make available to companies a tool that will allow them to easily update the report provided.

I am independent and would like to present an investment opportunity to you. Will I be paid for doing so?

We naturally compensate business introducers. This retrocession is made solely on the success fee and varies between 10 and 20% of this commission, depending on your involvement in the project.

Investment Fund

Investment Fund

My investment fund has a portfolio of multiple holdings. Can I onboard them all onto the platform?

We can evaluate and value all your investments as a single entity. These documents can also be used for regular reporting purposes for your Limited Partners, ensuring complete independent analysis. This also allows you to use them as a benchmark for a liquidity event occurring during your investment period.

Is it possible to onboard a stake that has not immediately planned an operation on its capital?

An assessment and valuation are not necessarily linked to a financial transaction. A simple data update will be necessary to proceed with a debt issue or a strengthening of the company’s equity.